Seeka Kiwifruit Industries

Six Months to 30 June 2014 [Unaudited]

The directors and management are pleased to present Seeka’s financial results for the six months to 30 June 2014. Profit before tax this half year is ahead of the previous corresponding period (pcp) by $1.6m reflecting greater post harvest kiwifruit volumes along with increased orchard and emerging business earnings. The half year results include a gain amounting to $1.4m on the sale of OPAC and include the new grower share scheme expense amounting to $1.9m (the first shares will be issued under the scheme in the second half of the year). The company is satisfied with the profit increase for the six months despite challenging trading conditions and rising costs.

Market share grew for Hayward to an estimated 24.8% but slipped to 10.6% in the Zespri SunGold variety. Many gold orchards are still to reach commercial fruit volumes. Gold market share is expected to rebound when re-grafted SunGold orchards reach commercial volumes in 2015. Detailed planning is underway to ensure Seeka has the capacity and infrastructure to meet processing demand and perform well for Hayward and other variety growers next year.

The post harvest environment remains competitive. Margins are tight as post harvest companies drop prices to attract custom. While capacity is overall expanding to handle greater volumes of fruit, a competitive environment is expected to continue. Seeka remains well prepared with active cost management, low core debt and competitive positioning complemented by performance, service and price. Seeka’s emerging retail service activities are also contributing to revenue and profit.

Seeka continues with the strategy outlined at the shareholders’ annual meeting: rationalise asset holdings and position the company to pay increasing dividends. Seeka continues to explore opportunities to diversify and to innovate in support of our core business. For example, Seeka in the past six months initiated collaborative marketing programmes which lifted company revenues as well as increasing the wealth of all kiwifruit growers.

Seeka purchased Glassfields, a retail services business in April. Glassfields provides ripening services, operates a small wholesale market and imports bananas, pineapples and papaya from Sumifru for ripening and supply to retail. These activities have been merged with our SeekaFresh business.

OPERATING PERFORMANCE

Operating revenue totalled $79.2m, up 18.3% from the pcp and comparable to same period two years ago.

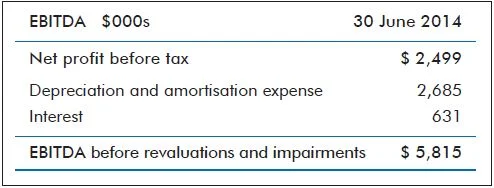

EBITDA1 of $5.8m is up 38.6% from the pcp. This includes the sale of OPAC shares contributing $1.4m and the anticipated cost of the grower incentive scheme amounting to $1.9m.

The increased EBITDA1 reflects growth in volumes, and the higher earnings of both orchards and SeekaFresh. Post harvest packed 1.4 million trays and loaded out 1.5 million more trays than in the pcp. Orchard EBITDA1 increased by $401,000 from the pcp, reflecting higher yields and higher market returns. SeekaFresh2 earnings were up by $1.1m from the pcp, reflecting increased earnings from the 2013/14 avocado crop and the new Glassfields business.

Profit before tax for the six months was $2.5m, up from $850,000 in the pcp. Profit after tax totalled $1.5m, up from $672,000 in the pcp. eeka will provide full year guidance at its shareholder update in October.

Negative operating cashflow of $9.2m compares to $2.9m in the pcp. The operating cashflow includes the cost of $4.2m for two orchards which have since been sold. The sale went unconditional on 4 July and settlement will occur in the second half of the year. The remaining negative cashflow reflects the seasonal nature of Seeka’s business, where expenditure and activity is higher in the first six months of the year.

Overall debt increased this half year. Total debt of $32.3m at 30 June 2014 compares to $23.6m at 30 June 2013, and compares to $20.6m at 31 December 2013. The 2014 debt level includes the two orchards awaiting settlement. The purchaser of those orchards has made a long-term packing commitment with Seeka.

Debt levels also include the Glassfields purchase and associated working capital. The $5.4m purchase price was partially offset by the $3.1m OPAC sale. The orchard crop in store at 30 June 2014 totalled $11.6m, compared with $9.6m in the pcp.

FOR MORE INFORMATION CONTACT

Michael Franks

Chief Executive

021 356 516

Stuart McKinstry

Chief Financial Officer

021 221 5583